Share The Wealth (and Reduce Your Taxes)

“I have a disproportionate amount of money to share. My approach to philanthropy will continue to be thoughtful. It will take time and effort and care. But I won’t wait. And I will keep at it until the safe is empty”

Despite the pandemic, charitable giving was a priority for many households in America that were fortunate enough to be in a position to give back. According to Giving USA Foundations annual report, charitable giving increased by 5.1% to a record $471 Billion in 2020. Amazingly, 68% of those donations came from individuals. You can see below that charitable giving has increased steadily over the past several decades. Giving back to those less fortunate or to causes that will better our world comes as reward enough. But there are smart ways to do it financially. The world needs us and there is certainly not a lack of causes in the world today: hunger, climate change, education, mental health, medical advances, just to name a few. We can choose to give to charities in many ways, both financially and non-financially. Many non-financial donations are done through time/volunteers, skills, or giving away goods. One of the biggest ways we donate is simply through financial means.

Americans Give A Record Amount To Charity in 2020 - Market Watch

Giving USA Foundation

A true example and inspiration to give back to the world has been MacKenzie Scott, ex-wife of Amazon founder Jeff Bezos. Within a few months of her divorce in 2019 MacKenzie Scott signed the Giving Pledge. The Giving Pledge was created by Bill and Melinda Gates and Warren Buffet in 2010 for wealthy philanthropists to give away the majority of their wealth. You can read her letter to The Giving Pledge and from other philanthropists who have joined the initiative on their site. The Giving Pledge - MacKenzie Scott

In total MacKenzie Scott has given away $8.5 Billion in the few years, to a variety causes.

$1.7 Billion to 116 organizations in July 2020

$4.1 Billion to 384 organizations in December 2020

$2.7 Billion to 286 organizations in June 2021

She announces these donations through her blog post with a message and list of all donors, preferring to keep it discreet. You can read her message and see the list of all recipients on her blog here.

MacKenzie Scott's Money Bombs Are Reshaping America - Bloomberg

MacKenzie Scott Is Giving Away Another $2.8 Billion To 286 Organizations - NPR

As advisors for your money and financial structure, it is our duty to maximize your wealth efficiently. There are gifting strategies that allow you to use the wealth created from the stock appreciation in your portfolio in a manner that is both tax efficient and beneficial to a cause. As opposed to cash donations, you should consider gifting highly appreciated stock which can potentially be a better way to donate.

For example, two standout stocks that illustrate what owning a stock over the long term looks like in wealth creation, just consider two of the most well know companies on the planet Apple and Amazon. These companies were not always the biggest at what they do. They too at one point were start up companies that have evolved into top well known household names. If you were fortunate enough to be investors in these companies, you have made a lot of money over the past several years.

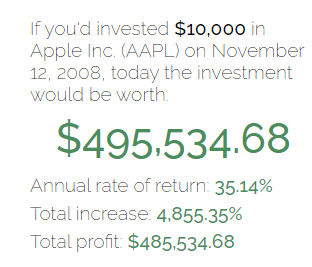

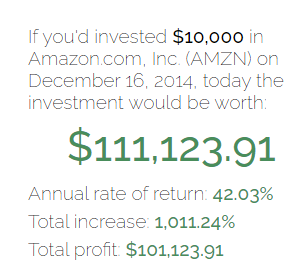

We started buying clients shares of Apple stock on November 12, 2008, and shares of Amazon stock on December 16, 2014. Below is a chart showing what you would have made in these names since those dates if you invested $10K into each company when we first began buying them.

A $10K investment in Apple stock in November 2008 would be worth approximately $495K today, a gain of $485K!

A $10K investment in Amazon stock in December 2014 would be worth approximately $111K today, a gain of $101K!

How Much Apple Stock Has Grown Last 10 Years - CNBC

Of course, at some point taxes become an issue and consideration around selling stocks when managing your portfolio. Gifting shares of highly appreciated stock can accomplish the following:

Satisfy charitable giving goals

Reduce portfolio risk in an individual stock position

Eliminate capital gains tax on donated shares

Reduce tax bill, depending on your specific tax situation

Allow others to benefit from potential stock appreciation over time

Donor Advised Funds have become an increasingly easy way for individuals to gift financial assets to charity. There are many advantages in gifting stock specifically. In the case of Amazon and Apple, as these stocks have gained significantly they become a bigger piece of a portfolio, putting more risk and exposure in a few names. Thus, gifting some shares may reduce risk to individual companies while eliminating gains on shares donated.

One of the best features of Donor Advised Fund is that they are flexible regarding the timing of donations and naming of charities. You get an immediate tax deduction although you may decide later which charities you want to support and when you want them to receive your gift. With concerns around taxes increasing and the way deductions are today, it may make sense to ‘bunch’ donations. This means donating more now, say a few years worth or more of your goal now, then nothing for the next few years. This may allow you a greater potential deduction and tax benefit overall. The Donor Advised Fund will still allow you to distribute in future years.

I’ve included some of the highlights for Donor Advised facts and features, bulleted below.

Some basic attributes:

Minimal investment to fund the account, irrevocable (no startup costs)

Immediate tax benefit

Gift with cash or securities (eliminate capital gains tax on highly appreciated stock)

Charles Schwab Charitable is the custodian for these assets

Recommended distribution to charities is 5% (may not be required) of account value per year

Do not need to declare charities upfront, funds are invested until the donor decides where and when to donate

The charity must be a public charity qualified under 501c3 by the IRS

Of course, we should coordinate with your CPA, a strategy and amount that makes sense for your overall situation. We can assist with opening a Donor Advised Fund through Schwab which you can view, title, and monitor. It is very quick and easy, like opening an investment account.

Thanks to the trust and support of our clients, Hamilton Wealth donates 1% of gross revenue to the LA Food Bank. Hamilton Wealth - Giving Back

Before the pandemic, there was an estimated 1 in 5 people in LA County that lived with food insecurity. After the COVID outbreak, it is now estimated that 1 out of 4 people face food insecurity. The LA Food Bank provides food to approximately 900,000 people each month.

We are happy to discuss if gifting stock makes sense for you and your portfolio.

Thanks,

Jerry

747.208.4300

©2019 HAMILTON WEALTH | PRIVACY POLICY

BROKERCHECK | CLIENT RELATIONSHIP SUMMARY

Hamilton Wealth, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Hamilton Wealth, LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Hamilton Wealth, LLC unless a client service agreement is in place.