Big Data, Big Brother

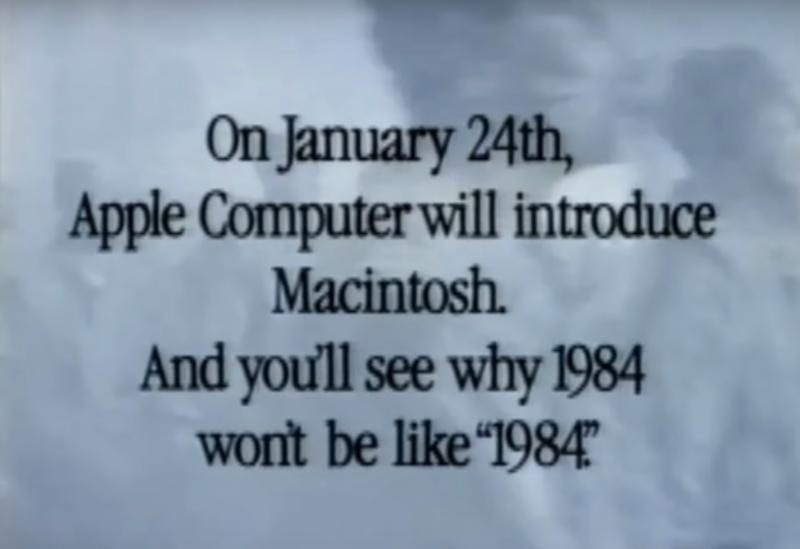

source: YouTube Apple's 1984 Superbowl commercial for the new Macintosh

““Not so many years ago when authors wrote about life in the future they generally portrayed the world of their imagination as blissful indeed compared with the unhappy present. Utopia was just around the corner: if science couldn’t solve our problems political and social reorganization could. But that was in another century and, besides, such hopes are dead.””

In Brief:

Technology is enhancing our lives, and growing our portfolios, but tech has a dark side

The government under the guise of ‘defense’ is spending our tax dollars to spy on Americans, the NSA surveillance program is hurting U.S. companies (and their stocks)

I remain bullish long term on cyber security, e-commerce, alternative energy, and smartphones

Unlike the partisan hacks in Congress, the Federal Reserve is achieving its mandate of maximum employment and low inflation, and thanks to them our economy is growing

Government spending fails to protect us from the genuine threats to our livelihood

We should trim positions which have become overvalued: utilities, staples, Palo Alto Networks and FireEye

We should diversify our bonds and buy municipal (tax-free) bonds

Technology’s most exciting developments lie in healthcare

The computer science that spawned the internet, which may go down as the most transformative technology of our time, has brought so much joy, productivity and efficiency to our lives. How did we ever get by without email, texting, GPS, the iPhone, Amazon, Google, Open Table, Waze, YouTube, Uber, etc? Wonderful technology, and in some cases, wealth building investments, but unfortunately, very effective tracking devices. All of this technology, along with our tax dollars, has provided the U.S. government the means to build the greatest ‘Orwellian’ surveillance system on the planet. The Macintosh may not have made life like ‘1984’….but the iPhone sure has. Oh, the irony. Click here: United States of Secrets - by Frontline on PBS and Citizen Four Documentary Film and Widespread Government Spying - Barry Ritholtz

But it’s not just 'Big Brother' watching us online. Like the NSA, the Chinese and Russians have become world class hackers. In the summer of 2013, in a cover story for Fortune magazine Kevin Mandia, then CEO of cyber security firm, Mandiant, announced to the world that the cyber-attacks being waged on U.S. companies, is not the handy work of hoody wearing teenagers in their parents' basement. It’s the Chinese military. I began researching cyber security and recommended last year that we gain exposure to this fast growing sector. One of the best performing stocks from this sector over the past year is Palo Alto Networks, up over 105% since recommending last year…and FireEye is one of 2015’s top performers.

Several of our positions are off to a strong start this year:

Guggenheim Solar (TAN $45.44) +33%

FireEye (FEYE $41.33) +32%

Amazon (AMZN $375.21) +22%

Palo Alto Networks (PANW $141.27) +17%

Apple (AAPL $127.24) +14%

(Current prices as of 3/23/2015, Year to date performance thru 3/20/2015, source: Morningstar.com. The S&P 500 is up 2.5%)

More important than the performance of these individual stocks in a single quarter, is that the sectors in which these companies participate, (cybercrime, e-commerce, smartphones, alternative energy) are long term, sustainable themes in my opinion. Some thoughts on each:

Cyber security: 85 million Americans recently had their medical files stolen from large health insurer Anthem (myself included). These files are worth significantly more than credit card data files on the black market. I suspect it’s only a matter of time before our electrical grid or stock exchange is compromised. Companies are not doing enough to protect us. Class action lawsuits will force corporations to spend more on information technology security software, and that’s bullish for our holdings. However, cyber security stocks have become overvalued and no longer trade on fundamentals but rather on the fear of future data breaches. I believe the prudent move is to trim our positions. Apple CEO Tim Cook speaking at Obama's cybercrime summit

E-commerce: Amazon had a rough 2014…the Fire Phone flopped spectacularly, they had an ugly PR battle with book publishers and they failed to meet earnings expectations due to massive reinvestment in infrastructure. The stock fell 30% presenting us with a buying opportunity. It appears those investments in fulfillment centers are paying off. Amazon announced this week that same-day delivery is now available in two more cities, Baltimore and Miami. Two-hour delivery is free and one-hour delivery is available in certain areas for $7.99. Amazon expands same-day delivery to Baltimore & Miami

Alternative energy: Last year alternative energy collapsed with oil, as it’s assumed that wind and solar energy can’t compete with cheap fossil fuel. Half of our political leaders may not believe in Climate Change but the scientists at NASA sure do: NASA study on carbon emissions and mega-droughts. In addition, some of the brightest CEO’s are putting big money behind solar: Apple Invests $850M in a Solar Farm and Google Invests $300M into Solar Projects with Solar City

Smartphones: Bill Gates became one of the richest men on the planet because he demonstrated how everyone needed a personal computer. Steve Jobs, with the introduction of the iPhone in 2007, put the computer in our pocket. Now his successor Tim Cook, has introduced us to what may become the first mainstream wearable device, the Apple Watch. We will not fully understand its capabilities until application developers attempt to create apps that will make the watch indispensable. I remain bullish on Apple due to the growth overseas of the iPhone6 and 6 Plus, Apple Pay and the App Store. Analysts maintain BUY ratings on Apple following watch introduction.

I believe our holdings have plenty of upside over the long run, but obviously there are no guarantees. Barron’s published an interesting piece recently comparing the largest stocks from 2000 at the height of the Tech Bubble, to today’s 10 largest companies. Notice only 3 companies made both lists (Microsoft, Intel and Cisco). Will Apple, Google and Amazon remain in the top 10 fifteen years from today? Fast moving technological advances pose a threat to all of these companies (remember Palm, Nokia, Blackberry, Motorola, Sony)

However, government policy also poses a threat to American businesses. The U.S. government went after Microsoft in the 90’s, and it appears Europe may do the same to Google. Our government’s spying program is hurting American companies (and their stocks). Click on the following links for related articles:

China State Media: Apple iPhone 6 Poses National Security Threat

Chinese Buyers are Shunning IBM, EMC, Oracle and Cisco

Google's life in Europe about to get a lot harder

American businesses need China for future growth. Our portfolios need the Chinese consumer. Apple iPhone sales were up 70% in China last quarter.

99 Problems but the Fed Aint One

The United States central bank, the Federal Reserve, has 2 mandates: employment and inflation. If you’re keeping score it would be difficult to argue with their success. The U.S. economy added 257,000 jobs in January, 295,000 in February, and more than 1M jobs over the past 3 months, the best 3 month period since 1997! And inflation, a steep rise in prices, which was feared by many (myself included) when the Fed began 'printing money', is plainly in check. We may have hit a bit of a soft patch this quarter, possibly weather related (similar to last year), but the U.S. economy remains the bright spot in the global economy. We continue to plod along, despite the numerous headwinds overseas and the ineptitude in DC. And for that reason, U.S. stocks are not cheap, they’re elevated.

“Export growth has weakened. Probably the strong dollar is one reason for that…On the other hand, the strength of the dollar also in part reflects the strength of the U.S. economy.”

Certain members of Congress have been highly critical of the Federal Reserve and are pushing to 'audit the Fed.' In my opinion this is classic scapegoating. Mr. Congressman, the Fed has been very busy cleaning up the mess you helped create:

-You turned a blind eye as Wall Street banks peddled millions of fraudulent mortgages. You slapped them on the wrist with fines (Bank of America, $120B, JP Morgan $70B, and Citibank $25B) and rewarded them by making them bigger! Too Big to Fail (and jail) banks have paid $251B in fines since 2008

-You marched us off to endless wars in the Middle East, for which our grandchildren will be footing the bill…wars that have helped push our national debt to over $18 trillion

-Social Security is insolvent by 2033 unless something is done, Social Security insolvent by 2033 according to government report

-Thanks to Citizens United, our democracy is eroding as corporate money taints our elections

-You've done nothing to address our overheating planet, We're running out of water - Time Magazine

-Income inequality is at its highest on record, Income inequality will end in higher taxes, revolution, or war

-Our public schools, bridges, roads and airports are a national disgrace, American Society of Civil Engineers grade U.S. roads, schools, & drinking water a D

Congress fails to accomplish anything and all the media wants to talk about is the 2016 presidential 'auction.' In my opinion, all of today’s front runners are status quo American 'royalty', too far detached from the Middle Class, and entitled. We need new blood. We need a new system.

Where the United States remains firmly at number one...spending on ‘Defense’. (I didn’t see a separate line item for spyware):

We spend over $600B a year on ‘defense’ and yet we can’t take care of our veterans according to a recent report from Veterans Affairs: Veteran Suicides: 22 a Day.

“Protracted religious wars have been around throughout history. They seem interminable while underway. They resolve only after one side is exhausted. And those who intervene tend to become casualties themselves. Has America learned this lesson? The answer will be revealed in Washington, where our broken political system seems to evolve ever-more dysfunctional means and methods.”

I don’t fear ISIS or Al-Qaida. Heart disease or cancer will most likely kill me and my loved ones. Where’s the ‘War on Cancer’? On processed sugar? On factory farming? On the Big Food lobby?

Next year, in the heat of the presidential auction, we’re going to hear plenty about the Middle Class. We’ll be asked to pay higher taxes to help close the income inequality gap, that our government helped create. I suggest we demand our leaders address the real threats to our livelihood with the trillions of tax dollars we give them annually. What’s been the ROI (return on investment) on the ‘War on Terror’? Looks a lot to me like the ‘War on Drugs’.

I believe it would be prudent to ‘take some chips off the table’ and trim what has become pricey:

-Utilities

-Consumer Staples

-Palo Alto Networks

-FireEye

-U.S. Treasuries

I suggest we use the proceeds to add to our existing positions in healthcare (aging population) and telecom (stable dividends). And we should diversify our fixed income allocation and buy tax-free bonds, as I believe taxes are heading higher.

We’ve got plenty of problems, but an economy that is growing 1M jobs a quarter, with low interest rates, low inflation, and cheap energy, is typically not one with a recession or bear market in its near future. However, as we’ve seen this year, temporary pullbacks or corrections should be expected, especially at these elevated prices. Technology has greatly enhanced our lives (and our portfolios) and we’re going to hear more on in the near future on 3D printing, connected cars, IOT (Internet of Things) and virtual reality. But technology’s most exciting developments lie in healthcare and longevity. More on that later…

Please let me know if you have any questions. I look forward to discussing with you at your earliest convenience.

Thanks,

Randy

This commentary on this website reflects the personal opinions, viewpoints, and analyses of the Hamilton Wealth, LLC employees providing such comments and should not be regarded as a description of advisory services provided by Hamilton Wealth, LLC or performance returns of any Hamilton Wealth, LLC investment client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Hamilton Wealth, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.