Bitcoin, Bots & Botox

In Brief:

Bitcoin, a classic bubble

Job loss due to technology will accelerate

Robotics is in a long-term uptrend

The backlash against Big Tech

U.S. stocks are expensive on a historical basis

Rebalancing to maintain prudent diversification

Where we see value: overseas, telecom, assisted living, and beaten down healthcare

2018 top priority: reassess your risk tolerance (Riskalyze)

“Stay away from it…the idea that it [bitcoin] has some huge intrinsic value is just a joke in my view.”

At the risk of sounding like a luddite, I suggest you steer clear of the Bitcoin mania. I’m not an expert in cryptocurrencies but I’ve witnessed massive bubbles in my 25 year career: tech stocks in the 90’s, and real estate 2003-2008. In both instances, there existed the narrative ‘it’s different this time’. Internet stocks are different, and should not be valued the same way Coke & Disney are valued. In the mid to late 2000’s low interest rates (and lax lending standards), ignited demand for housing. Investors were convinced real estate would never decline in value because ‘they’re not making any more land.’ FOMO, or the fear of missing out, caused normal rational beings to get overleveraged. Of course, these bubbles popped, as they tend to do, wiping out virtually all gains. Tech stocks fell 80% from 2000-2002, many of course went to zero. Amazon, a real business, fell 90%! The real estate bubble imploded leading to the Great Recession. Bitcoin fans claim that the digital currency is scarce and must be ‘mined.’ How do we truly know bitcoin is scarce? There is virtually no transparency. How do we not know that the people who originated bitcoin (also unknown) are not hoarding it? How soon before Google, Amazon, IBM, and the government create their own competing digital currency? The IRS has ruled that gains must be tracked & taxed.Thus, scarcity and lack of regulation, two of bitcoins most mentioned attributes, may be short lived. Digital currency and blockchain technology may eventually be applied to real world applications, but it’s way too early to decipher the ultimate winners in this space. Here are what some smart folks are saying about Bitcoin:

“Bitcoin is successful only because of its…lack of oversight…it ought to be outlawed, it doesn’t serve any useful social function…it’s just a bubble.”

“My best guess is that in the long run, the technology will thrive, but that the price of bitcoin will collapse.”

For decades politicians have promised Americans they would protect their jobs from going overseas. Of course, this never happened, dollars chased cheap labor outside of the United States, eliminating millions of jobs. Textile mills in the Carolinas and Virginia which employed more than 2 million Americans are gone. The steel mills in Pittsburgh have been replaced by hospitals. Detroit and my hometown of Cleveland suffered as manufacturing plants went overseas and became automated (robotics). Politicians blamed unions, immigrants, China, and other politicians. Instead it was technology. The pressure on CEO’s to compete globally, forced them to embrace the internet, Microsoft, Intel, Cisco, etc, to improve the bottom line. Today retail jobs are evaporating every month due to Amazon. How many media jobs have been lost to Facebook? The bad news is that job loss due to technology is going to get worse, much worse. Our elected officials are not addressing this. We are not allocating enough resources to prepare our workforce for this new reality. Its obvious education is not a priority for our government-politicians are more consumed with raising money for their re-election campaigns. The combination of this fast approaching wave of automation, with a rapidly aging population, and $20 trillion debt…we are not as hopeful as markets may lead you to believe.

“It saddens me to say it, but we are approaching the end of the automotive era…because travel will be in standardized modules…vehicles will no longer be driven by humans because in 15 to 20 years — at the latest — human-driven vehicles will be legislated off the highways…Everyone will have five years to get their car off the road or sell it for scrap…We don’t need public acceptance of autonomous vehicles at first. All we need is acceptance by the big fleets: Uber, Lyft, FedEx, UPS, the U.S. Postal Service, utility companies, delivery services. Amazon will probably buy a slew of them…These modules won’t be branded Chevrolet, Ford or Toyota…I think everybody sees it coming, but no one wants to talk about it.”

This is a stark warning for everyone, in every industry. No one will be spared the societal impact of the next massive wave of job displacement due to automation, artificial intelligence, and robotics. If you think the debate over healthcare spending is brutal today…wait 10 years, when there are millions more receiving Medicare and Medicaid benefits…and millions more unemployed due to technology. Kiva robots (owned by Amazon) are killing retail. The destruction of retail jobs at the hands of e-commerce has huge ramifications that are not being fully appreciated. Walmart is the biggest employer in 22 states! Politics is going to get even uglier…

The backlash against big tech is upon us…and when I say ‘upon us’…please understand that our portfolios could be impacted.

See Also:

Robots will destroy our jobs - and we're not ready for it - The Guardian

The Silent Crisis of Retail Employment - The Atlantic

Autonomous vehicles could cost America 5 million jobs - LA Times

Silicon Valley Techies Are Not the Good Guys - Wired

The stock market has been around for over 120 years. Stocks have never been more expensive than they are today, except on two prior occasions: leading up to the 1929 Crash that lead to the Great Depression, and in 2000, at the height of the Tech Bubble. On both instances, stocks went on to fall by more than 50%.

The problem with stock market valuations is that they tend to be a lousy predictor of future returns. Expensive stocks can stay expensive for a long time (late 90's), and high valuations alone are not a reason to sell (valuation would have forced us out of Amazon a long ago). We are big believers in portfolio rebalancing to maintain prudent diversification. The challenge of rebalancing is that it entails selling or trimming your winners and taking the proceeds to buy what has not participated in the rally, or losers.

The market has barely shrugged at the threat of nuclear war with North Korea, Brexit, the Russian attack on our elections, a bold face liar in the White House, and the Federal Reserve raising rates. When will markets reverse course into the next bear market? This is impossible to forecast but Nobel prize winning economist Robert Shiller has the best answer I’ve ever heard:

“The next big crash occurs when people think other people are changing their minds. I don’t have a precise way of forecasting. It could come soon…earnings growth has been strong over the past year. That doesn’t mean you should be confident about the market. Earnings growth was almost 20% in the year before the 1929 peak…it didn’t make any difference.”

US. stocks are expensive, now what? We favor overseas markets to U.S. markets:

S&P 500 (SPY) average rate of return over the last 10 years: +8.2%

All other foreign markets (VEU) combined over same 10 years: +1.98%

source: Morningstar.com, 12/14/2017

We don’t believe technology’s performance is sustainable. We like the global telecom sector for low valuation (PE ratios), poor sentiment/low expectations, and high dividends:

source: Bespoke Research, 12/14/2017

Certain sub-sectors of healthcare appear lofty (medical devices, up 30% this year) but there are some beaten down names that are attractive on a risk reward basis. We continue to like healthcare-related real estate. The fear of rising interest rates have caused real estate and real estate investment trusts to lag the market. We believe this is an opportunity to gain more exposure to senior housing.

Analyst comments on HCP, one of the country’s largest health care REITS:

“…the vast baby boomer generation (those born between 1946 and 1964) is still in the early stages of becoming eligible for Medicare and entering senior adulthood, a period of life that historically exhibits roughly 3 times as much total personal healthcare spending per capita as that for other adults. These factors should drive demand for healthcare services for years to come and disproportionately reward top owners and operators of healthcare real estate...”

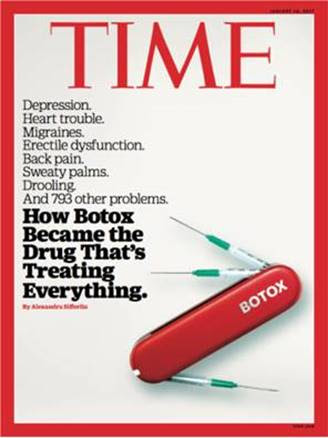

Allergan, the maker of Botox is down more than $100/share over the past year as investors are concerned about generic competition. We suspect those fears are overblown. Analysts at Morningstar claim the stock is worth $263/share, or nearly $90 more than its current price.

“Although Botox does face competition for its largest indication—the cosmetic removal of facial wrinkles—management has expanded Botox’s market into numerous therapeutic categories where it essentially enjoys a monopoly. Current approved therapeutic indications include blepharospasm, strabismus, cervical dystonia, severe primary axillary hyperhidrosis, upper limb spasticity, chronic migraine, and urinary incontinence…We imagine Allergan can maintain a historical success of fending off most generic threats through patent litigation and new product launches.”

source: TIME - 1/16/2017

The rebalancing process for 2018 starts with assessing your risk. It is impossible to predict the next recession, but if history is any guide, stocks may fall 25%-50%. Can you stomach this kind of volatility in your portfolio? Want to know how your existing portfolio would perform in another 2008-type market crash? We’ve contracted with RISKALYZE to help determine your risk tolerance, and identify the risk lurking in your portfolio (stress tests). We will send you a link to a quick Riskalyze questionnaire that shouldn’t take you more than 5 minutes to complete. Once you’ve completed the questionnaire, Riskalyze will automatically send us the results. We’ll review the results and determine if your risk tolerance aligns with your existing portfolio, and what adjustments we should consider.

I look forward to discussing further with you.

Wishing you and your families a safe and happy holiday!

Thank you,

randy

This commentary on this website reflects the personal opinions, viewpoints, and analyses of the Hamilton Wealth, LLC employees providing such comments and should not be regarded as a description of advisory services provided by Hamilton Wealth, LLC or performance returns of any Hamilton Wealth, LLC investment client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Hamilton Wealth, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.